Michigan Medicare Part D: Unlock Hidden Savings You Didn't Know Existed

Medicarehealthassess.com Hopefully your spirit will never go out. This Second I want to discuss the advantages of Medicare for Senior that are widely sought after. Discussion About Medicare for Senior Michigan Medicare Part D Unlock Hidden Savings You Didnt Know Existed Don't stop in the middle of the road

Michigan Medicare Part D: Unlocking Your Hidden Savings

Are you a Michigan resident navigating the complexities of Medicare Part D? You're not alone. Many beneficiaries find themselves overwhelmed by the sheer number of plans and the potential for significant savings that often go unnoticed. This article is your guide to understanding Michigan Medicare Part D, uncovering those hidden savings, and ensuring you're on the most cost-effective path for your prescription drug needs.

Understanding Medicare Part D: The Basics

Medicare Part D is the prescription drug benefit offered by Medicare. It's designed to help individuals cover the costs of their prescription medications. Unlike Original Medicare (Parts A and B), Part D plans are offered by private insurance companies that have been approved by Medicare. This means there's a wide variety of plans available, each with its own unique formulary (list of covered drugs), copayments, deductibles, and coverage gaps.

Why Part D Matters for Michigan Residents

For Michigan seniors and individuals with disabilities, managing prescription drug costs is a critical aspect of their healthcare. The rising price of medications can put a significant strain on budgets. Medicare Part D provides a crucial safety net, but only if you choose the right plan. Without it, you could be paying full price for your medications, which can be astronomically high.

The Importance of Choosing the Right Michigan Medicare Part D Plan

The key to unlocking savings with Medicare Part D lies in making an informed decision. It's not a one-size-fits-all situation. What works for your neighbor might not be the best option for you. Several factors come into play when selecting a plan:

Your Prescription Drug Needs

This is arguably the most important factor. You need to know which medications you take regularly. Does your doctor prescribe brand-name drugs or generics? Are your medications on the plan's formulary? If a drug isn't on the formulary, you might have to pay the full cost, or the plan might not cover it at all. Many Part D plans have tiered formularies, where generic drugs have lower copays than preferred brand-name drugs, and non-preferred brand-name drugs have the highest copays.

Plan Costs: Beyond the Premium

While the monthly premium is the most visible cost, it's far from the only one. You need to consider:

- Deductible: This is the amount you pay out-of-pocket before your Part D plan starts to pay for your prescriptions. Some plans have no deductible, while others can have deductibles of several hundred dollars.

- Copayments and Coinsurance: These are the amounts you pay for each prescription after you've met your deductible. Copayments are usually a fixed dollar amount (e.g., $10 for a generic), while coinsurance is a percentage of the drug's cost (e.g., 25% of the brand-name drug cost).

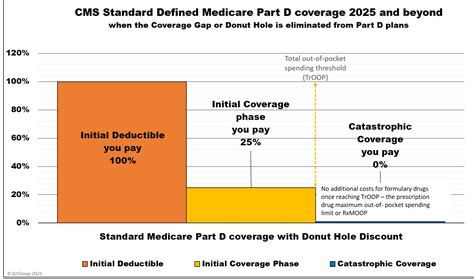

- Coverage Gap (Donut Hole): Once your total drug costs (what you pay and what your plan pays) reach a certain limit, you enter the coverage gap. In this phase, you pay a higher percentage of the cost for your drugs. However, for brand-name drugs, you pay 25% of the cost, and for generic drugs, you also pay 25% of the cost.

- Catastrophic Coverage: After you spend a certain amount out-of-pocket in the coverage gap, you reach catastrophic coverage. In this phase, you pay a small coinsurance or copayment for your drugs for the rest of the year.

Formulary and Pharmacy Network

As mentioned, the formulary is crucial. Ensure your current medications are covered and check the tier they are placed in. Also, consider the plan's pharmacy network. Do your preferred pharmacies participate in the plan? Using an out-of-network pharmacy can lead to higher costs.

Strategies to Unlock Hidden Savings in Michigan Medicare Part D

Now that you understand the fundamentals, let's dive into the strategies that can help you save money:

1. Annual Enrollment Period (AEP) is Your Golden Opportunity

The Annual Enrollment Period (AEP), which runs from October 15th to December 7th each year, is your chance to review and switch your Medicare Part D plan. This is when insurance companies release their new plan offerings for the upcoming year. If your current plan's costs are increasing, or if better options are available, this is the time to act. Don't just stick with your current plan out of habit; actively compare options.

2. Consider Generic Medications Whenever Possible

Generic drugs are chemically identical to their brand-name counterparts but are significantly cheaper. If your doctor is willing to prescribe generics, or if you can ask for them, you can dramatically reduce your out-of-pocket expenses. Many Part D plans offer the lowest copays for generic medications.

3. Explore Mail-Order Pharmacies

Many Medicare Part D plans partner with mail-order pharmacies. These pharmacies often offer a 90-day supply of your medications for a lower cost than a 30-day supply at a retail pharmacy. This can be a significant saving, especially for long-term medications. Just be sure to factor in shipping times and ensure you have enough medication on hand.

4. Understand the Coverage Gap (Donut Hole) and How to Navigate It

The coverage gap can be a source of unexpected costs. However, there are ways to mitigate its impact:

- Manufacturer Discounts: While in the coverage gap, you receive discounts on brand-name drugs. These discounts count towards your out-of-pocket spending, helping you reach catastrophic coverage faster.

- Generic Drugs in the Gap: As mentioned, you pay a lower percentage for generic drugs in the coverage gap, making them a more affordable option.

5. Look for Plans with Lower Deductibles and Copays

While plans with lower premiums might seem attractive, they often come with higher deductibles and copays. If you take a lot of prescription drugs, a plan with a slightly higher premium but lower out-of-pocket costs for your specific medications could be more cost-effective in the long run.

6. Utilize Pharmacy Discount Cards (with Caution)

Some discount cards can offer savings on prescription drugs, even if you have Medicare Part D. However, it's crucial to compare the prices. Sometimes, the plan's copay will be lower than the discounted price. Never use a discount card if your Medicare Part D plan covers the drug at a lower cost. It's best to ask your pharmacist which option is cheaper for each prescription.

7. Check for Extra Help Programs

For Michigan residents with limited income and resources, there are programs designed to help with Medicare costs, including prescription drugs. Extra Help is a federal program that can lower your Part D premiums, deductibles, and copayments. You can apply for Extra Help through the Social Security Administration.

People Also Ask: Common Questions About Michigan Medicare Part D

Here are some frequently asked questions that can further clarify your understanding:

What is the best Medicare Part D plan in Michigan?

The best plan is subjective and depends entirely on your individual needs. There isn't a single plan that is universally the best for everyone. To find the best plan for you, you need to compare plans based on your specific medications, preferred pharmacies, and budget. The official Medicare website (medicare.gov) is an excellent resource for comparing plans available in your area.

Can I change my Medicare Part D plan outside of the AEP?

Generally, you can only change your Medicare Part D plan during the Annual Enrollment Period (October 15th - December 7th) or if you qualify for a Special Enrollment Period (SEP). SEPs are typically triggered by specific life events, such as moving, losing other coverage, or having a change in your Medicare or Medicaid status. It's important to check the specific SEP rules if you believe you qualify.

What happens if I don't enroll in Medicare Part D when I'm first eligible?

If you don't enroll in a Part D plan when you are first eligible and don't have other creditable prescription drug coverage (coverage that is at least as good as Medicare's), you may have to pay a late enrollment penalty if you decide to enroll later. This penalty is added to your monthly premium for as long as you have Part D coverage.

How do I know if my current Part D plan is still the best for me?

You should review your Part D plan every year during the Annual Enrollment Period. Look at your plan's Summary of Benefits and the updated formulary. Compare the costs of your current medications under your existing plan versus new plans available in your area. Factors to consider include changes in premiums, deductibles, copays, coinsurance, and whether your medications are still covered at a reasonable cost.

What is creditable prescription drug coverage?

Creditable prescription drug coverage is coverage that is expected to pay, on average, at least as much as Medicare's standard prescription drug coverage. Examples include employer-sponsored retiree drug coverage or TRICARE. If you have creditable coverage, you generally won't need to enroll in a Medicare Part D plan to avoid a late enrollment penalty.

Expert Tips for Maximizing Your Savings

As an expert in this field, I can offer a few more nuanced tips:

1. The Power of the Formulary Tier System

Pay close attention to the drug tiers. Most plans have 4 or 5 tiers. Tier 1 is typically for generics with the lowest copay. Tier 2 might be for preferred brand-name drugs, Tier 3 for non-preferred brand-name drugs, and higher tiers for specialty drugs or drugs with limited coverage. Understanding these tiers can help you anticipate costs and make informed choices about your medications.

2. Don't Overlook the Donut Hole Discounts

While the coverage gap can be daunting, remember that the discounts you receive on brand-name drugs in the gap count towards your out-of-pocket maximum. This means you'll reach the catastrophic coverage phase sooner, where your costs are significantly lower. Always ask your pharmacist if a brand-name drug has a manufacturer discount available.

3. The Importance of a Medicare Plan Finder

The Medicare.gov Plan Finder tool is your best friend. It allows you to input your medications, dosages, and preferred pharmacies to compare all available Part D plans in your specific Michigan zip code. It will show you estimated annual costs, including premiums, deductibles, copays, and coverage gap costs. Take the time to use this tool thoroughly.

4. Consider a Medicare Advantage Plan with Drug Coverage

Many Medicare Advantage (Part C) plans include prescription drug coverage (Part D) as part of the package. These are often referred to as MA-PDs. If you're considering a Medicare Advantage plan, ensure it includes drug coverage and compare its total costs (premium, copays, deductibles) with Original Medicare plus a standalone Part D plan. Sometimes, an MA-PD can offer a more streamlined and cost-effective solution.

5. Stay Informed About Medicare Changes

Medicare rules and plan offerings can change annually. It's essential to stay informed about these changes, especially during the Annual Enrollment Period. Subscribe to reliable Medicare news sources or consult with a SHIP (State Health Insurance Assistance Program) counselor in Michigan for personalized, unbiased advice.

Conclusion: Take Control of Your Prescription Drug Costs

Navigating Medicare Part D in Michigan doesn't have to be a confusing or expensive ordeal. By understanding the basics, actively comparing your options during the Annual Enrollment Period, and employing smart strategies like choosing generics and exploring mail-order pharmacies, you can unlock significant savings. Remember, the goal is to find a plan that best suits your individual needs and budget. Don't leave money on the table – take the time to research and make informed decisions about your prescription drug coverage.

Thus I have explained michigan medicare part d unlock hidden savings you didnt know existed in full in medicare for senior Please apply this knowledge in your daily life look for positive inspiration and stay fit. Help spread it by sharing this post. Thank you